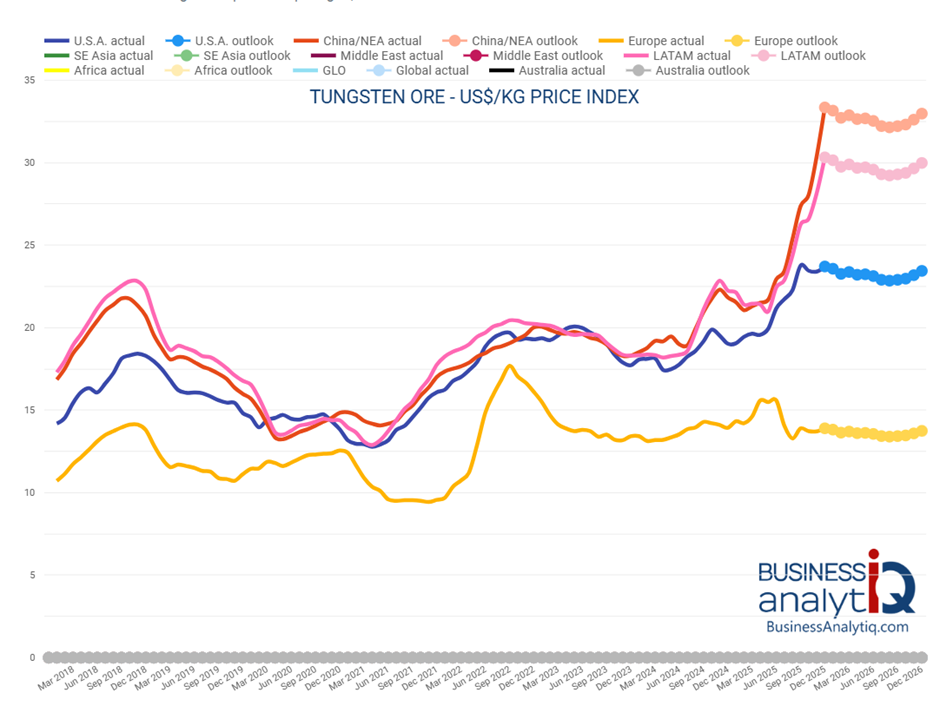

When 2025 began, I don’t think many of us anticipated just how aggressively commodity prices would move. Gold, cobalt, silver and most critically for our business, tungsten, all saw sharp and sustained increases.

Against a backdrop of many mining companies actively pursuing cost savings, it became a constant balancing act between price, wear life, and maintaining sustainable profit margins. That tension is nothing new for any business, but it becomes far more challenging when one of your key input materials is both undersupplied and increasingly expensive.

Throughout the year, tungsten pricing has not only risen, it has become harder to predict. That uncertainty flows directly through to unit cost, stock availability, manufacturing lead times, and ultimately the risk profile of the product once it is installed on a machine.

What carries into 2026?

For the mining industry more broadly, 2026 is unlikely to look materially different to 2025. Outside of a few notable exceptions, particularly gold, silver, and copper operations, many sites are still operating under relatively flat commodity pricing.

At the same time, labour pressures remain, ESG expectations continue to expand, and digitisation and governance requirements are increasing rather than easing. Operational complexity is rising, while tolerance for cost overruns is not.

What this means for GET and hardfacing strategies

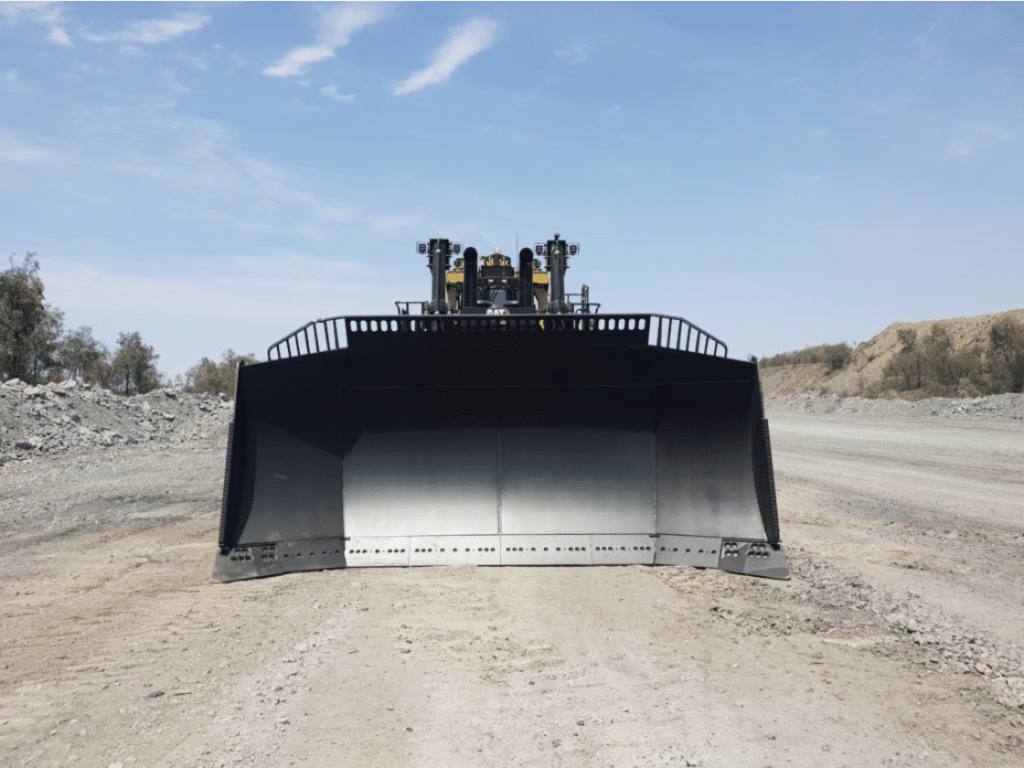

From a Ground Engaging Tools perspective, 2025 reinforced an important reality: wear life alone is no longer the sole decision metric.

As tungsten prices continue to rise and it is difficult to see a scenario where this trend meaningfully reverses, the way hardfacing is applied becomes just as important as the material itself. How much is applied, where it is applied, and whether it genuinely aligns with site-specific wear patterns now has a far greater influence on the cost-to-benefit outcome.

Unnecessary or poorly targeted hardfacing can quickly erode the very $/hour benefit it is intended to deliver, particularly as input costs rise.

We are not yet at a point where tungsten hardfacing no longer makes sense for moderate to high wearing mine sites. However, this is the first time in my 13 years in the business that the margin between cost and benefit has felt this tight. The room for error is shrinking, and decisions need to be more deliberate than ever.

Where the biggest gains are really found

One of the clearest lessons reinforced over the past year is that some of the greatest gains for both GET suppliers and mine sites come not from the product itself, but from more open and honest communication. During one extended wear trial that ran for approximately 18 months, I was able to gain invaluable insight into what mine sites actually value and, more importantly, how decisions are really made. Working with a site that was willing to be direct (sometimes uncomfortably so) fundamentally changed my understanding of the internal drivers behind adoption, rejection, and delay.

If you think you know how decisions are made on a mine site, it is worth challenging that assumption. Any proposal must pass through many hands, each with different priorities, risk tolerances, and performance metrics. Success requires far more than a part number and a promising wear claim.

What sites ultimately need is an undeniable case study, one that stands up to scrutiny across maintenance, procurement, planning, and management. Achieving that takes time, effort, and, most importantly, collaboration.

The real game changer is when site contacts are genuinely invested in the outcome: when they want to see improvement, are willing to give a supplier a fair opportunity, and provide access to capture data, document performance, and track a component from install through to removal. That level of engagement reduces risk for the site and ensures suppliers are solving real problems rather than theoretical ones.

Trials, trust, and the path forward

As an industry, we still see relatively limited uptake of hardfacing across a wide range of GET, despite its potential benefits. Reluctance to trial remains strong, and trust in smaller aftermarket suppliers is understandably earned slowly.

That places the responsibility squarely on suppliers to operate differently. To be consultative rather than transactional, to recommend improvements only where they genuinely make sense, and to remove friction from the trial process rather than add to it.

At Plasma Wear Parts, we enter 2026 with trials scheduled in Western Australia that will provide valuable real-world data, particularly around how advanced hardfacing solutions perform under current cost conditions. At the same time, it remains important not to overlook standard blade solutions combined with proven wear patterns that balance performance, predictability, and price.

Looking ahead

Despite the challenges, the outlook is not pessimistic. Even in a tightening environment, meaningful and repeatable cost savings remain achievable. In many cases, they come not from radical product changes, but from better alignment between application, wear pattern, and operating conditions.

The opportunity still exists for sites willing to invest a small amount of time and collaboration upfront to unlock substantial savings across their fleet.